palm beach county business tax receipt phone number

200 Civic Center Way Royal Palm Beach FL 33411 Map If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits HuntingFishing Licenses or any other County Tax related business OTHER THAN registering for a Business Tax Receipt please call 561 355-2264. Contact the Tax Collectors at 561-233-355-2264 or visit the website at.

Box 3353 West Palm Beach FL 33402-3353.

. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX. This Tax Receipt expires on the date shown. Palm Beach FL 33480.

Hours Monday - Friday 800 am - 400 pm. West Palm Beach FL 33402-3715 OvernightExpress Mail Tax Collector Palm Beach County 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 Our Client Advocate assists clients with web-related issues. If this is NOT correct contact the Tax Collectors office at 561 355-2272.

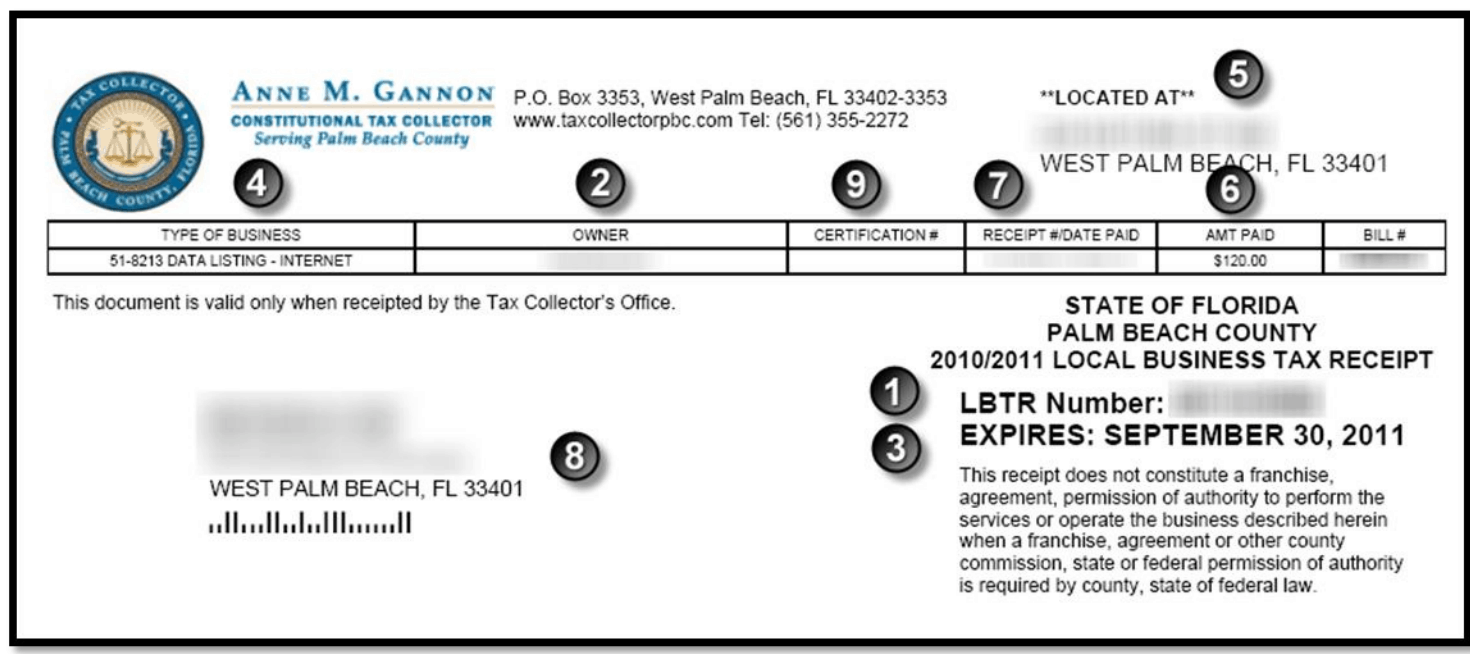

This is a unique number assigned to each business. Host a licensed hotel motel inn or other traditional hospitality property. Tax Receipt Sample.

YOU WILL BE CONTACTED VIA EMAIL WITH NEXT STEPS AND PAYMENT OPTIONS. LBTR Number is a ten-digit number found on your Business Tax Receipt. Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500.

360 South County Road. There may be other requirements in order to issue your business tax receipt. 8719 business tax email address business tax.

Be sure to complete this specific Business Tax Receipt application form. The City of West Palm Beach Business Tax classifications and rate schedule can be found in Section 82-163 of our municode. Royal Palm Beach FL 33411.

Please refer to this number when making inquiries. If you have a problem or question you need help with select the appropriate topic from the forms to the right. 1050 Royal Palm Beach Blvd.

If the use meets the Zoning Code requirements then the applicant will pay a fee schedule inspections receive the appropriate sign-offs from zoning code enforcement and fire rescue then submit the completed form to the Tax Collectors office who will then issue the Business Tax Receipt. The entire LBTR number must be entered to perform a search. Constitutional Tax Collector Serving Palm Beach County PO.

For specific businesses or if you are unsure please call 561-799-4216 for fee estimates. 561 227 - 6411. Allow 7 to 10 business days to process.

These fees are for the most common type of applications.

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Local And County Tax Receipt Laws In Palm Beach County

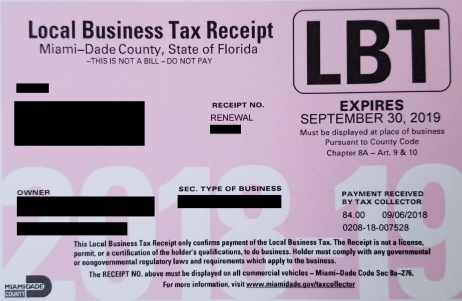

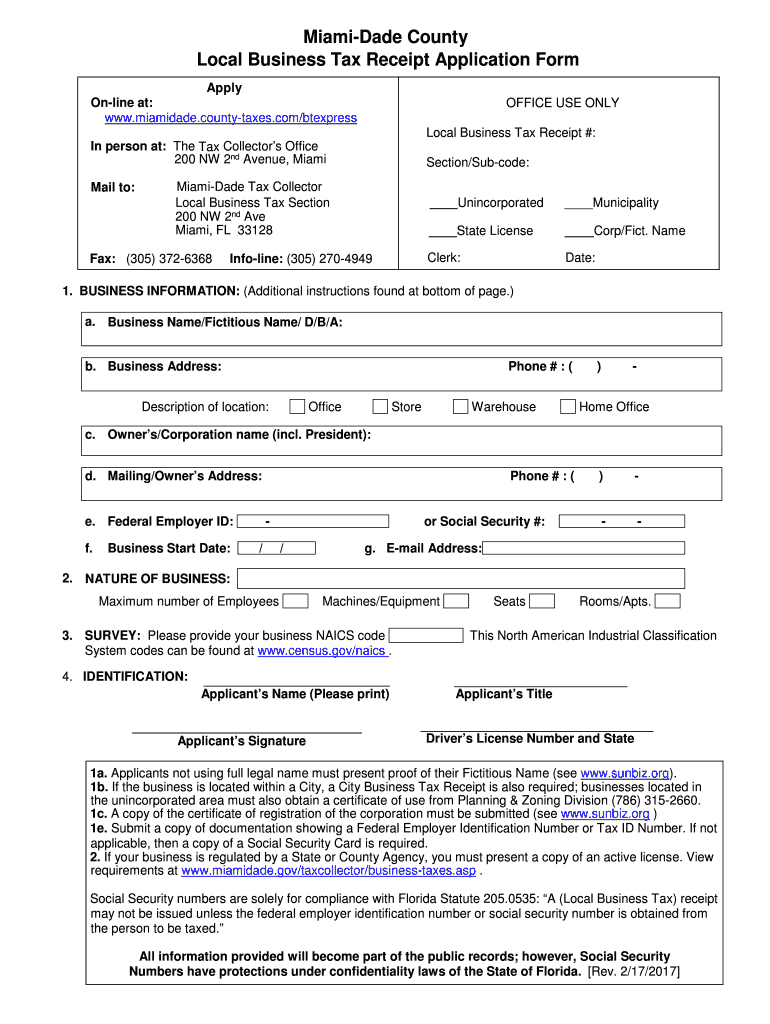

Miami Dade County Local Business Tax Receipt 305 300 0364

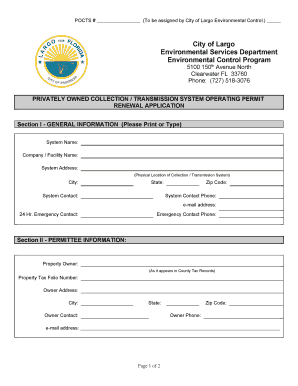

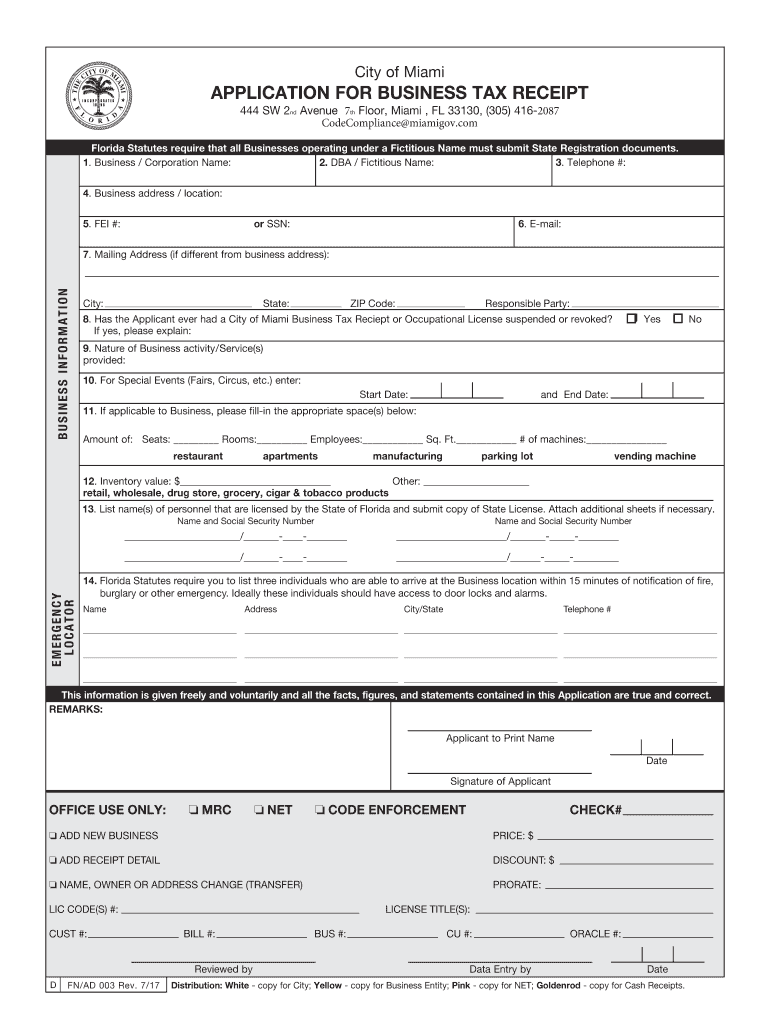

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Local Business Tax Constitutional Tax Collector

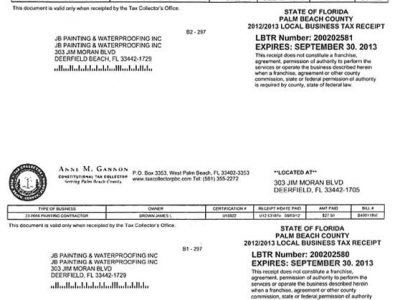

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

Permit Source Information Blog

Pembroke Park Area Broward County Local Business Tax Receipt 305 300 0364

Palm Beach County Local Business Tax Receipt 305 300 0364

Permit Source Information Blog

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller